How to find investors for a startup [fundraising guide + message templates]

Did you know that 90% of startups fail due to cash flow problems and poor marketing strategy implementation? Fundraising is hard, especially if you’re just foraying into the startup world and lack a network of investors.

Although cold emailing investors is still one of the most popular ways to reach them, in reality, most angel investors may ignore an email as they receive hundreds daily.

So what’s a better alternative?

Social media outreach, specifically LinkedIn, for B2B prospects.

A study suggests that entrepreneurs actively networking on social networks are more successful than founders without an online presence. The same study also revealed how founders’ LinkedIn profiles were positively correlated with the amount of funds raised by companies. For example, founders with more LinkedIn followers raised an average of $2.1 million each year, while the overall average stands at $1 million.

That’s why in this article, we’ll help you uncover where to find investors for a startup and how to build a multichannel communication system via LinkedIn + email.

First, let’s learn what it takes to build multichannel communication.

Build a multichannel communication with investors

Multichannel communication is a marketing technique used to reach out to target audiences through several marketing channels, such as social media, email, and phone calls.

For our use case of fundraising for a startup, we’ll focus on building multichannel communication with investors via LinkedIn outreach and email.

But why LinkedIn and email? LinkedIn’s research shows that for 89% of marketers, LinkedIn generated 2x more leads than other channels. This is followed by email, which generates 50% more sales in B2B than other communication channels.

Let’s find out how to leverage LinkedIn and email to build out a multichannel communication strategy.

The following steps are just for startups like you who are looking to build a valuable database of investors and kick-start a cold outreach strategy:

1. Where to find investors for your startup?

You can find worthy stakeholders in three places: through your existing connections, joining an online community, or attending industry-specific events.

Let’s discuss them briefly.

Investor networking websites

- AngelList

Website: angellist.com

Investors: Angel investors funding tech startups, venture capitalists, and advisors.

AngelList is a US-based platform for fundraising and connecting with angel investors and limited partners.

- Angel Capital Association

Website: angelcapitalassociation.org

Investors: Pre-qualified angel investors

Angel Capital is a US-based non-profit association that connects active seed-stage investors across the globe.

- Crunchbase

Website: Crunchbase-find investors

Investors: Angel investors, Private firms, Venture Capitalists

Crunchbase aims to help startups explore the right investors among its vast database and lets founders monitor competition.

Investor networking events

Industry events happening online and offline are exceptional breeding grounds to build connections with potential investors.

You could search for LinkedIn events, contests, pitch competitions, and startup drives, like so:

- Y Combinator

Website: ycombinator.com

Event: Tech Startup Accelerator

Y Combinator runs a bi-yearly three-month startup accelerator program which is a mentorship-based event to provide startups with guidance, limited funding, and support in exchange for equity.

- MIT $100k Pitch

Website: mit100k.org

Event: Entrepreneurship competition for students and researchers

MIT’s 100k Pitch is a competition consisting of pitching, acceleration, and launch that takes place each year. Winners are offered grand prizes such as startup funds and mentorship from top stakeholders.

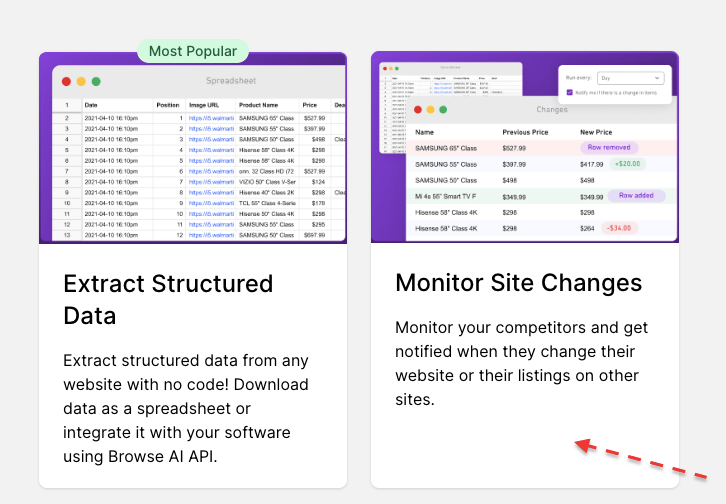

2. Scrape the list of investors with Browse AI

Once you’ve found relevant potential investors in step one, say, through a website like AngelList or Crunchbase, it’s time you scraped the investor list so you can gear up for your multichannel outreach process.

We’ll be using Browse AI to scrape investors on Crunchbase:

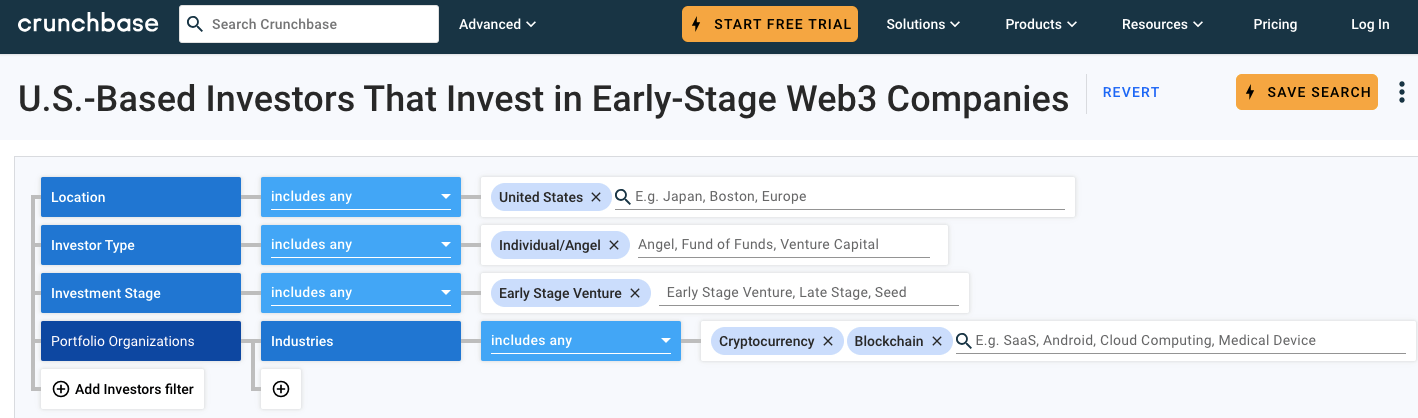

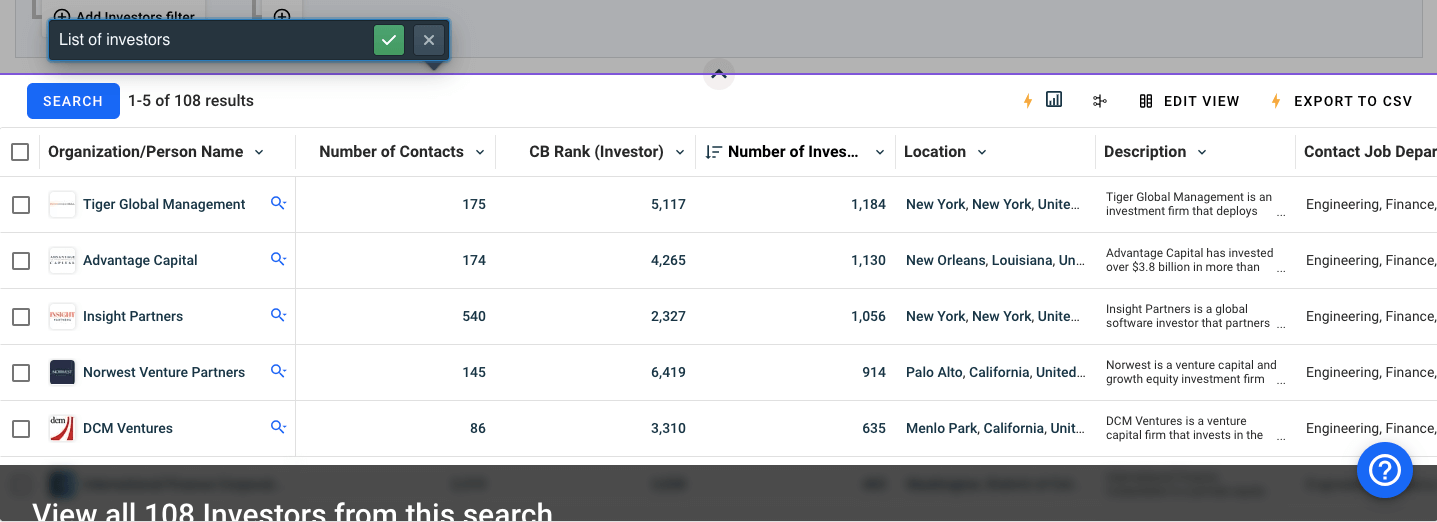

- Head to Crunchbase lists and add a filter based on location, investor type, etc., like so:

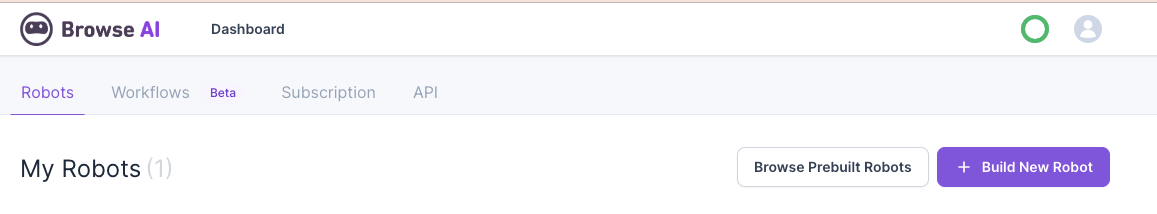

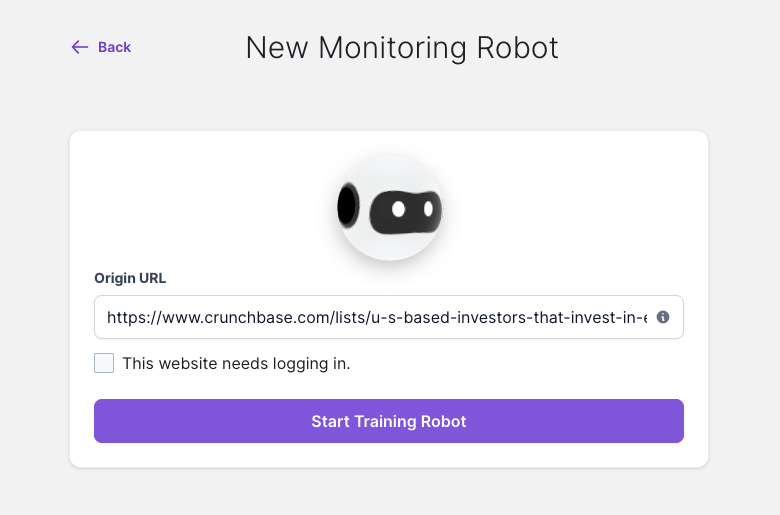

- Create a free account on Browse AI and select Build New Robot

- Choose the type of scraping. Since we want the robot to monitor the website only for a specific set of investors, we can choose “Monitor Site Changes.”

- Paste the Crunchbase search URL and select Start Training Robot:

- Capture the list of investors, enter a name for the selected list, and select Finish Recording to finish scraping.

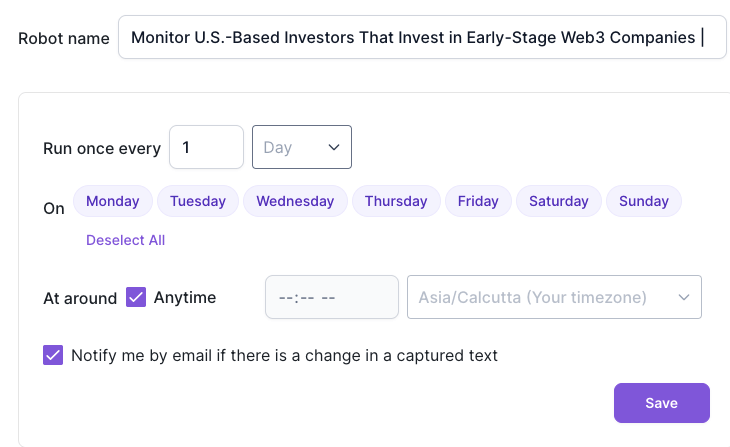

- You can set up the robot to monitor for any changes happening to the captured investors list and update you of changes, like so:

Click Save. Next, you’ll be redirected to download the scraped investors list as a CSV or JSON file.

Pro tip: To get your data enriched and keep an up-to-date investors list, we suggest you connect Browse AI with Google Sheets. It’s pretty simple: Head to the Integrations page on Browse AI, select “Google Sheets,” choose your Google account, create a new Google Sheet, and save the integration!

3. Enrich data with LinkedIn profiles

Most angel investor databases like Crunchbase or AngelList do not include the investors’ LinkedIn URLs.

But as mentioned, a multichannel outreach through LinkedIn + email is an indisputable way to get investors’ attention to your startup.

Here’s Expandi’s trick for fetching investors’ LinkedIn profiles in two simple steps:

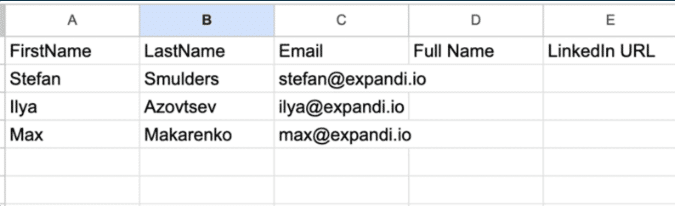

Step 1: Clean up your Google Sheet

Ensure there’s a column for LinkedIn URL and full name:

Step 2: Add our ready-to-paste script

On your Google Sheet, click Extensions > “App Script” > delete any pre-existing code/text > copy our code.

To find the code and detailed steps, download our free step-wise guide here.

You’re now just one step away from reaching out to investors!

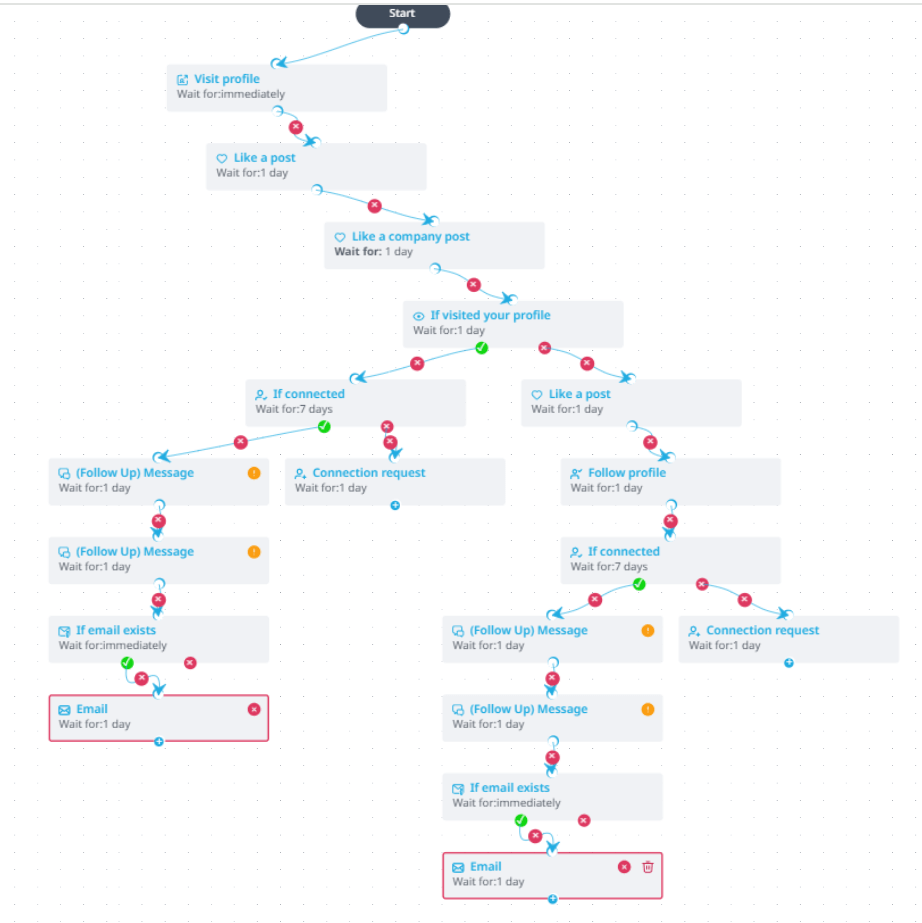

4. Create a Smart Sequence campaign with Expandi

Expandi’s Smart Sequences offers a safe way to build a multichannel outreach flow through LinkedIn and emails.

You can set up a sequence with predefined actions to “warm up” before sending a LinkedIn connection request to a potential investor. For example, liking their LinkedIn posts, visiting their profiles, or endorsing a skill.

Here is the exact roadmap to setting up a Smart Sequence on Expandi and tripling investor response rate:

Step 1: Add warm-up steps

Warm-up steps ensure potential investors recognize you when they receive your LinkedIn connection message, InMail, or email.

For example, LinkedIn sends a notification to potential investors when you visit their profile or like their posts. This way, your avatar and name will look familiar to investors when you send them a LinkedIn connection request.

Using Expandi, you could build a Smart Sequence where you auto-visit a potential investor’s LinkedIn profile, then auto-like an investor’s post and send a personalized connection request after they’ve visited your profile.

Pro tip: Use your LinkedIn name and avatar for email outreach to potential investors so they recognize you.

Step 2: Send a connection request if they visit your profile

A potential investor visiting a profile is indicative of interest in knowing more about the startup. It’s also a great conversation starter for sending connection requests and building a new connection.

Alternatively, if an investor fails to visit your profile, you could build a workflow to send the connection request after another attempt to draw their attention through other warm-up actions like liking posts or re-visiting their profiles.

So, if an investor visits your profile after a set wait time, it’s time to jump into the occasion and send them a personalized LinkedIn connection message to introduce yourself and your startup.

Here’s a template you could use:

Hey [first name],

Noticed you visited my profile. I checked out your profile as well, and I must say your posts on [topic] really stand out.

I’m a startup founder at [company name] and would be glad to have a thought leader like yourself in my network.

So let’s connect and stay in touch?

[your signature]

Step 3: Send the first LinkedIn follow-up message if connected

You can set up the Smart Sequence to follow up with the potential investor a day or two after they’ve accepted your connection request.

Here’s a template you could use:

Glad to connect with you, [first name]!

I noticed your interest in platforms within [niche]. I’m happy to connect with someone with similar interests. My venture, [name], is within the same niche, and I would be more than happy to get your feedback on my tool.

Would you like to receive and try it out for 30 days?

I would love to talk a bit about my venture — [company name]. We are a bootstrapped company in [sector/service]. Check out our case study with […].

I noticed you’ve spoken extensively about our service in your posts and talked about it at [event name].

Let me know if you’re free tomo at 5 PM for a quick virtual catch-up!

Step 4: Send the second LinkedIn follow-up message if there’s no response to the first follow-up

You could add an additional wait time of 1 day after sending the first follow-up to send the second one.

Here’s a template you could use:

Knock knock, [first name].

My previous message may have been lost in the abyss

I would love to talk a bit about my tool — [name]. We are a bootstrapped company in [niche]. Check out our case study with […].

I would love to receive feedback from an expert like you. Would you like to try my tool for free and drop your valuable insights?

Let me know if that works for you!

Step 5: Send an email follow-up after two LinkedIn follow-ups

It happens. Prospects get busy and may need a little push to notice your message. That’s why we shall include an email follow-up within our multichannel outreach to investors.

Expandi’s Smart Sequences lets you add a condition where you can auto-follow up with prospects via email after following up via LinkedIn, say, after a day’s gap.

Note: Head to the Profile Settings section in your Expandi account and select Email integration to set up SMTP before sending email follow-ups.

Here’s an email template you could use:

Hi [first name],

We recently connected on LinkedIn and wanted to give a quick intro here.

[Startup Name] is a [Business Model] for […]. We [State Mission Statement]. Early customers that we’ve acquired perform […%] better and stay […%] longer.

We focus on [Target Market/Sector/Position] and are growing our metrics […%] month over month. We could complement their portfolio well.

Check out our case study with […].

View our pitch deck by clicking […].

Would love to know your thoughts.

[Your signature]

This way, you can add about 11 actions and 10 conditions to automate investor outreach using Expandi’s Smart Sequences!

4 simple tips for networking with investors

With investors, time is money. So here are a few tips to make the best use of your and your potential investor’s time while networking:

-

Have a handy roadmap ready

Investors may be considering a myriad of startups for investing. So, unless your potential investors are friends or family, they need solid social proof to place their bets on your startup. That’s when having a clear-cut vision in the form of a roadmap makes a vast difference.

Have a roadmap that outlines what your startup is aiming to achieve, the MVP, how you plan to execute your idea, what your timeframe is, and what resources from the investor would help you achieve your business goals.

Create a brief pitch deck that gives investors a top-level view of the product, resources, and monetization mechanisms.

You could create a handy pitch deck to include your step-by-step roadmap. Also, have a ready-to-go speech prepared for the advisors on board with your plan. All these can be a key deciding factor behind investors putting their money on the table.

If you’re yet to have advisors on board, you can always use Expandi’s outreach methods to invite them to your team.

-

Be prepared to refuse an inadequate offer

You’re most likely to receive offers that may require you to give up more equity or managerial hold at your own startup. Also, not all investors may have your best interest in mind or maybe in it just for some quick bucks.

On such occasions, it’s completely fine to say “no” while networking and move on.

So be prepared to reject an inadequate or unauthentic offer by setting clear boundaries regarding what the maximum you can give up or accept.

-

Have a 30-second pitch ready

When you’re networking at a physical event or on platforms like LinkedIn, the briefer your pitch is, the more likely you are to connect with a variety of suitable investors.

So instead of beating around the bush, wrap up your pitch into a short 30-second speech where you briefly explain what you do and what you plan to achieve with your startup.

For LinkedIn outreach, you could record this half-minute-long speech and send it as an audio file to your potential investors post-connection.

Tip: Have a cheat sheet with arguments and answers to FAQs ready with notes. This way, you won’t stumble when potential investors counter-argue. Rehearse answers before you start your pitch.

-

Have your finances in order

A clean record of finances, along with your business plan, can show potential investors how transparent you are. It is also ideal to add a plan on how you intend to distribute your funds, including projected profits and planned growth.

Although most startups may not have complex financial records, you can still ensure profit or loss statements are in perfect order.

Having such information handy signals investors you understand finances and that it’s safe to invest in your company.

Wrapping up

We hope our fundraising tips and tools give you the much-needed respite from worrying about finding worthy investors.

Here’s a quick wrap-up of your next steps:

- Scrape a list of potential investors using Browse AI on platforms like AngelList, Crunchbase, etc.

- Sign up for Expandi’s free trial or log in if you’re already a member

- Start building a Smart Sequence for a multichannel investor outreach process, as mentioned above

- Curate LinkedIn + email outreach messages by following our templates and tips

Follow these steps to hunt for the best investors for your startup and watch responses spike within the first few days!

You’ve made it all the way down here, take the final step