In B2B world, every single lead generated matters.

And usually, it’s crucial not to lose any of the leads you have because there aren’t many to begin with in B2B.

Additionally, every single lead has the potential to contribute to your direct revenue and scaling potential. Especially depending on your average deal size and customer lifetime value.

So, to make the most out of this, you need to be constantly tracking each stage your leads are in on their way to becoming paying clients.

This is where your B2B sales pipeline comes in.

No matter how well-defined your CRM process is or how great you are at sales, if you don’t know what actions and processes to take at each stage of a deal, it’s going to be impossible to scale.

You need to know if they have any objections, if you need to follow up in the future, and what are the exact next steps you need to take to bring your leads one step closer to paying customers.

Otherwise, you’ll be losing leads and be unable to grow as a business

In this guide, we’ll teach you how to set up your pipeline from scratch, and how to make it so that you know exactly what steps to take to start closing leads. Visibility is the key.

Here’s what we’ll cover:

- The difference between B2B sales funnels and pipeline

- How to build your own B2B sales pipeline from scratch: 6-step process

Need help generating leads on autopilot for your B2B sales pipeline?

Be sure to join our private community called The LinkedIn Outreach Family for proven outreach sequences, templates, best practices, and more.

Table of Contents

What Is The Difference Between A B2B Sales Pipeline And A Sales Funnel?

Your sales team is going to perform drastically better when they know what exact steps they need to take at what exact stage the lead is in.

Look at it from the perspective of your SDRs.

Having a strong sales pipeline is like giving them exact guidelines on what to do, when, and how.

So, at its core, a sales pipeline is an organized, visual way of tracking potential buyers, as they progress through different stages.

Below, we’ll be covering how this compares to your sales funnel and sales forecast, which are entirely different concepts.

Now, both sales pipelines and sales funnels are built around your processes.

But the main difference is the perspective.

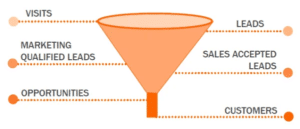

A sales funnel is about leads. It shows how many leads are on each stage of the buyer’s journey. And what that buyer’s journey looks like, going from a visitor to a paying customer.

While a sales pipeline is the money.

More specifically, about how much revenue sales and marketing teams could generate and how many deals should be at each stage of the pipeline to achieve this revenue goal.

Let’s break this down a bit more.

- A sales funnel is built from the perspective of your leads. Its stages are based on your sales processes, looking through the eyes of your leads. By gathering data in a sales funnel report, you can see how leads react to your process and how they convert through the different stages.

- While a sales pipeline is also built from the perspective of Sales Development function. It includes the stages in your sales process, focusing on the actions your reps have to take to cultivate leads and close those deals. Inside the pipeline, reps can see the opportunities that are currently on the table, how close they are to a sale, and what the next steps are for each opportunity. Most CRMs include a pipeline view you can customize based on your processes and steps.

For instance, the main sales stages to evaluate the pipeline health could be as follows:

- Demo held.

- SQLs.

- Addressing issues.

- Trial or pilot started (OPP).

- Proposal made.

- Contract sent.

- Contract designed.

- Moved to finance.

- First payment captured (Won).

- Closed-lost.

Or I’d recommend designing or mapping them like this before the CRM implementation. So the whole logic and alignment is documented and clear to all stakeholders.

Sales Stage 👉 |

Sales Qualified ⬇️ |

Sales Accepted⬇️ |

Proposal⬇️ |

Sandbox⬇️ |

Negotiate⬇️ |

Contract Out⬇️ |

Conversion probability % 👉 |

0%

|

20%

|

50%

|

60%

|

75%

|

90%

|

Objective👉 |

Company is a “Fit Company” ICP deck Qualify the opportunity. Gather BANT / SPCED criteria

|

Sales to qualify the opportunity.

|

SE or AE setup integration including sandbox & drive data flow for the sample use case(s).

|

Prospect has agreed to move forward. Negotiate pricing and review terms.

|

If sending a contract, the Buyer needs to be ready to sign.

|

|

Stage Requirement👉 |

Meeting has been scheduled

|

Authority: Decision-making process Need: Does the prospect have a need that aligns with a product or solution? Need should be broken down by technical need, business need, and personal need Timeline: Prospect must have a timeline to solve the ‘Need’ Update the correct Close Month and next steps. Budget: Is there a budget allocated for this project? Yes or No? If not, can a business case be made? |

Continue to crystalize BANT and continue to map out the organizational structure

|

Confirm solution, use case(s), and success criteria If the sandbox effort needs engineers, require a scope, success criteria, and timeline approved by Sales Engineering Lead |

Update Forecast Category: - Commit / Best Case - Update CRM Notes |

Contract out for signature.

|

Requirement to Exit Stage👉 |

Fill out:

Problem to Solve Why Evaluate

|

Decision Criteria: Determine what criteria they’re factoring into their decision Identify Pain = Identify challenges and the consequences of solving or not Update CRM notes |

Champion identified. Executive Sponsor: Who is leading this initiative and why is it important to them Technical Lead: Technical champion Economic Buyer: Find out who owns the budget. Go Live Date: When with the prospect like to have a solution in place (not when we would like them to have a solution in place) Buying Process: Determine the buying process Update BANT fields. Update Forecast Category: Commit / Best Case |

Fill out: Problem to Solve Why Evaluate VGS Decision Criteria: Determine what criteria they’re factoring into their decision. - We want to have this align with your sandbox trail “ if we let you into a sandbox trail and we show we can hit these criteria in this trial will we be able to move forward? Identify Pain = Identify challenges and the consequences of solving or not solving those problems. Update SFDC Notes |

Prospect has agreed to terms and pricing. |

Signed and countersigned contract. Move opportunity to Ready to Close Stage. Deal vetting by finance and moved to closed-won. |

B2B sales pipeline vs sales forecast

Another thing worth defining, before we cover the actionable steps, is the difference between a B2B sales pipeline and a sales forecast.

People often use these two terms interchangeably, but in reality, they have different meanings.

Here’s the main difference between the two:

- A sales pipeline includes every opportunity a salesperson handles (no matter how new or experienced they are). Sales reps use the pipeline to track where prospects are across the sales process and then determine the most effective way to proceed.

- While a sales forecast estimates the opportunities or deals that are likely to close in a given timeframe. It shows your sales teams how close they are to achieving their goals or quotas, helping them prepare for what’s to come. When defining your sales forecast, you need to know how many leads and deals you need to have on every single stage to meet a certain number.

For example, if a sales forecast meets or is below the target goal, you should double down on selling activities.

As a rule of thumb, your sales pipeline should be 3 times more than the revenue target set, so, the probability of hitting that target is healthy and manageable.

Sales forecast is also based on the sales rep’s evaluation of how much they can close in a specific period, often a quarter. This depends on the conversion percentages, the number of deals or opportunities at each stage of the sales process, and your sales cycle.

To understand the final sales forecast you need to look at your pipeline. The final, and perhaps the most crucial, step is selecting a sales forecasting method that aligns with your SaaS business’s growth stage. There are various sales forecasting techniques available, but not all of them will necessarily match your business model and growth rate. If you’re just starting out, using Excel templates should do the job. However, for rapidly expanding businesses, relying solely on historical sales data won’t cut it.

Choosing the right forecasting model determines the accuracy of your cash flows.

Some of the sales forecasting models are:

- Lead-driven forecasting

- Length of sales cycle forecasting

- Opportunity stage forecasting

- Historical forecasting

- Multivariable analysis forecasting

Building A B2B Sales Pipeline: 6 Step-by-Step Tutorial

If you were to build a B2B sales pipeline from scratch, the main steps you’d need are as follows:

- Defining your sales pipeline sources.

- Defining your ideal customer, buyer’s persona, and market for each source.

- How to start prospecting and lead generation for your outbound, inbound, and partner-sourced leads.

- Lead qualification.

- Offer and negotiation phases.

- Sales pipeline B2B review and analysis.

Now, let’s break this down step-by-step.

1. Define your sales pipeline sources

This essentially means where your leads will be coming from.

Outbound, inbound, and partner-sourced leads shape what your pipeline will look like.

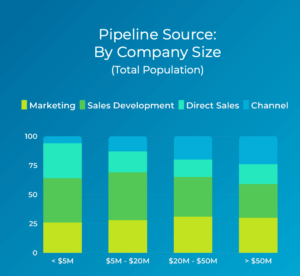

For example, one way to look at this is through the 10/30/60 ratio:

- 10% partners bring their own leads for sales to convert.

- 30% outbound proactively doing cold outreach based on your ideal customer profile. If you work in B2B, LinkedIn will be ideal for this, as that’s where your target audience is. You can also combine LinkedIn with email for a multichannel outreach. Though, keep in mind, from January 2024, a strict email policy will be introduced. According to the spam prevention policy update, Gmail will start to require that bulk senders authenticate their emails, enable easy unsubscription, and ensure they’re sending wanted emails. Making LinkedIn outreach even more important. Be smart.

- 60% inbound leads from advertising, SEO content, website, events and so on.

This ratio may vary based on stage of growth you are at.

Benchmarks tell us that the smaller the company – the bigger role Outbound leadgen plays there:

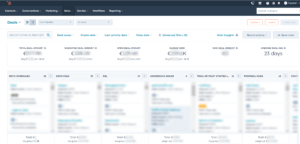

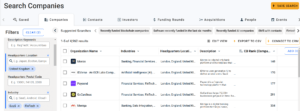

To better build your sales pipeline, you need to start with understanding your sources and knowing where your leads are coming from. Ideally, you should be tracking each source as a field as part of your CRM in analyzing and making better-informed decisions.

| Pipeline sources | Website (Demos, signups) | Content | Groups, Listings, Freelance websites | Social Media | Outbound lead generation | Referrals & Partnerships |

| Activities | SEO, Monitoring, Landing pages, Analytics | Blog, Comments in Articles, Quora, Reddit, Lead magnets | LI, Facebook groups, Telegram and Slack communities, Listings, Clutch, Good Firms, Capterra, Upwork, G2 and others | Facebook, LinkedIn, Instagram, Twitter, Ads | Outbound lead gen campaigns, Email Marketing | Current clients, partnerships |

| Tools | Leadfeeder (Dealfront), LeadInfo and others | Expandi

Feeder & Feedly |

Ad campaigns tools | Outreach, LI Sales Navigator, Crunchbase, Expandi, Intricately, ZoomInfo | Promoter.io, Proposify | |

| CRM & Scoring | ||||||

| Plans & OKRs & SMARTERs & V2MOMs | ||||||

2. Define your ideal customer, buyer persona, and market for each source

As part of your sales pipeline, you’ll have different types of clients, some of who will pay you more than others.

So, you’ll need instructions for your SDRs on how to work with different kinds of leads in order to convert them into paying clients.

What’s the difference?

- Ideal customer profile: Used to describe a type of a company that would be your ideal customer.

- Buyer persona: Semi-fictional representation of your customers. Helps you identify individuals with different job roles and decision-makers behind every purchase.

Then, you should:

- Clearly define your ICP-associated channels for each lead source, to ensure a consistent value proposition across all functions, for easier internal and external communication.

- Form your ICP across the levels of location, industry, target company size, and more.

- Define your buyer persona based on functions and titles.

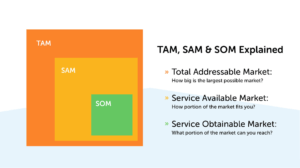

- Define your TAM/SAM/SOM to generate a list of companies that fit your criteria, based on market research and customer analysis).

- Finally, to access your TAM/SAM/SOM bases, leverage resources like Crunchbase, LinkedIn, Dealroom, or other platforms for startups and scale-ups

3. Start prospecting and lead generation for outbound, inbound, and partner-sourced leads

Naturally, this will depend on the specific strategy or lead source.

So, here’s a general overview:

First, when creating an outbound strategy, build a prospect list aligned with SOM, and prioritize based on internal fit criteria.

Then, you need to enrich your data and filter down your list.

Tailor an approach based on top-priority companies first. Utilizing AMB (account-based marketing) or personalization methods.

For second and third priorities, explore opportunities for increased automation. Develop a specific value proposition for each ICP, guiding a subsequent sequence creation.

The demand generation team should focus on attracting and nurturing your TAM/SOM/SAM bases, aiming to bring them to your website to book demo calls or sign-ups. Be sure to also employ SEO and nurturing techniques to make demos, sign-ups, webinars, and events the primary sources of your inbound pipeline.

Finally, with partner-sourced leads, formulate strategies to create opportunities through collaborations. Armed with the knowledge of your ICP, this should become easier over time.

Let’s generate an easy example.

If your goal is to get to a million dollars in ARR and your solution is for UK-based fintech companies, your best option would be to start with Crunchbase.

Select industry, location, and company size parameters to form an initial list. Do not forget to filter out companies via Company Operating Status field and Company Type (For Profit).

Keep in mind, this won’t be perfect yet but that’s fine, as you can refine it over time.

This list becomes a foundational asset for both marketing and outbound strategies.

Marketing here involves crafting a semantic core, creating lookalikes, and implementing various optimization techniques. Once you apply relevant ICP filters to Crunchbase, you should go through some of them manually to learn about them in more detail.

From there, your outbound team should select 500 companies for each SDR from the overall fit criteria companies list, and prioritize based on historical data and market insights. Then, they create an outbound sequence tailored for that market (in this case, UK fintech companies).

On average, one SDR should handle 20-30 prospects per day with a tailored and mindful approach.

Those companies SDRs engage with should also be nurtured by the marketing team for the much qualitative result that this synergy brings. I call it – healthy prospecting. Some others use the term – programmatic ABM.

To achieve accurate data, determine your average deal size. For example, based on how much your product costs, you’ll know how many clients you need to bring in to close that amount.

Then, how many leads are needed for that number of clients, based on the conversion rate you have through all stages of the funnel.

4. Lead qualification

At this stage, SDRs and BSDRs (business development representatives) qualify leads brought in by partners and marketing, before passing it to the sales team.

Done well, sales qualification reduces time required to decide of you’re talking to the right person.

Without having this step defined, you could be talking to hundreds of leads a day – only to end up with one or two closed deals to show for your effort.

You don’t want to work with clients who aren’t a good fit, right?

This could be because of budgetary issues, organizational challenges, or simply put, your solution might not be relevant to where they’re at right now.

Inset, you’ll want to pursue sales leads who are most likely to purchase your solution and properly get the most out of it.

Similarly, your target audience isn’t “everyone”. You have a well-defined, specific ICP for a reason.

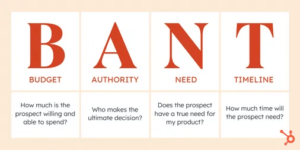

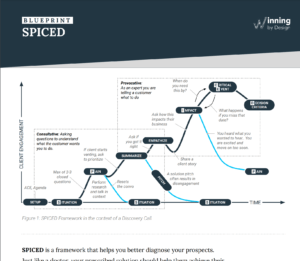

To qualify leads, you can use BANT or SPICED qualification frameworks. You can choose from the variety of methodologies, the only thing tha matters – is why you are doing that and if the chosen methodology helps aligning teams.

Here’s what these two frameworks stand for.

- Budget: How much is the prospect willing to spend on your solution?

- Authority: Who is the authority in this sales that will make the ultimate decision?

- Need: Does the prospect have a true need for the solution?

- Timeline: How much time will the prospect need to make a decision?

SPICED (Winning by Design)

- Situation: Facts, circumstances, background details about your prospect.

- Pain: Challenges that brought the prospect your way.

- Impact: How you impact your prospect’s business.

- Critical Event: Deadline to achieve that impact.

- Decision: Process, committee, and criteria involved in purchasing the solution.

You need to ask the above questions based on the framework to qualify leads before getting on a call with them.

If they don’t fit your criteria, then you simply disqualify them and move on to other leads in your sales pipeline.

For example, if a lead doesn’t have big enough budget to afford your services, it doesn’t make sense for you to work with them.

Alternatively, your solution might be the best fit for UK FinTech companies making at least 6-figures. As a result, you wouldn’t work with startups selling a health product, for example.

You don’t need to get on a call with someone to figure this out.

As you can simply go through their website, read the founder’s story, analyze what their solution is – and then make a well-informed decision.

5. Offer and negotiation

Based on 1 or 2 calls, the sales team should craft a proposal for the prospect, outlining the exact plan to achieve your solution.

Based on the prospect’s reaction, you’ll want to move them in your CRM from negotiation, procurement, and contract phases, leading to “close won”.

Depending on your sales cycle, you’ll have different stages where the offer and negotiations phase.

Typically, you’ll want to create a proposal based on what you discussed in the call. That might include things like:

- What service you’ll be providing.

- What are your deliverables.

- Timeline.

- Pricing breakdown.

- Who is responsible for what.

- And other expectations

But it’s not like you can just send the proposal and call it a day.

With tools like Proposify, you can track when exactly leads take a look at your proposal and for how long.

For example, once you gain a notification that they’ve opened your proposal (which you gain access to through sales tools like Proposify), you can send a follow-up message accordingly.

From there, you can expect 3 possible outcomes:

- They say yes – Naturally, this is the ideal outcome. If this happens, you move forward with your plan and complete the sale. Update your pipeline, mark as closed, and get ready to deliver on your offer.

- They say no – Rejections are common in sales. The key to handling a ‘no’ is how you decide to move forward. Ideally, you’ll want to find out why they’re refusing. Then, see if you can persuade or handle any possible objections they might have to working with you. Keep in mind though, you don’t always have to persuade them to buy. If they can’t afford your pricing, for example, you can either down-sell or they just might not be your ideal client. Make sure you keep track of objections or other reasons leads might say no.

- They don’t reply – If this happens and they disappear, make sure to send follow-ups. If they still don’t reply, it’s likely your pricing doesn’t work with them or they went with a competitor. Consider following up again in a few months.

6. Review and analysis

Last but not least, Sales and Marketing teams should systematically review past closed lost deals/opportunities, where the loss reasons were related to time, budget, or need constraints.

To improve your overall sales process, you should be looking at the average close rate, average revenue per account, overall pipeline value per stage, and conversion oneach stage of your pipeline.

Here, you should leverage your CRM and other tools you use for your sales processes to gain a data-driven approach to sales for best insights.

Look at metrics such as:

- Number of deals/opportunities in your sales pipeline at a given time.

- Average length of sales cycle (average time between deal’s entry and when it closes).

- Average deal size (average amount of revenue generated from a single closed deal).

- Leads to opportunities conversion rates that leads to true sales opportunities.

- Win rate (sales opportunities converted to closed sales).

- Pipeline value by stage (total value of deals in each separate stage of pipeline).

Occasionally, you can also launch outreach campaigns targeting companies that work with your competitors, and test new campaigns.

Final Words

So, to recap, creating a B2B sales pipeline can be a time-consuming, lengthy process.

But if you want to scale up as a business, it’s an essential step you can’t miss.

Done right, you’ll have a well-defined sales system getting you paying customers like clockwork.

With both your sales and marketing teams being on the same page on how to generate and close more meetings.

As you might have noticed, one important part of this process has to do with prospecting and outreach.

Expandi helps sales teams fully automate their outreach and nurture sequences.

You can automatically import LinkedIn searches, scrape groups or Sales Navigator filters, create a campaign in under 20 minutes, and start seeing real results in under 24 hours…